wake county nc sales tax breakdown

Wake Forest NC Sales Tax Rate The current total local sales tax rate in Wake Forest NC. The current total local sales tax rate in Wake County.

Search real estate and property tax bills.

. 3 rows Wake County NC Sales Tax Rate. North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any. This is the total of state and county sales tax rates.

6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina. Sales and Use Tax Rates. 22 rows The total sales tax rate in any given location can be broken down into state county city.

Learn about listing and appraisal methods appeals and tax. This takes into account the rates on the state level county level city level and special level. The most populous location in Wake County North Carolina is Raleigh.

The Wake County sales tax rate is. As far as all cities towns and locations go the. Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not.

Pay tax bills online file business listings and gross receipts sales. The 2018 United States Supreme Court. If you need access to a database of all North Carolina local sales tax rates visit the sales tax data page.

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200. Click any locality for a full breakdown of local property taxes. The North Carolina state sales tax rate is currently.

Prepared Food and Beverages This tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises by any retailer with sales in Wake County that. The average cumulative sales tax rate in the state of North Carolina is 694. North carolina has a 475 sales tax and wake.

Historical County Sales and. North carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. The average cumulative sales tax rate between all of them is 725.

Sales And Use Tax Rates Effective October 1 2020 Ncdor

Amazon Com Wake County North Carolina Zip Codes 48 X 36 Paper Wall Map Office Products

Wake County North Carolina Wikipedia

More From County Commissioners Budget Workshop Lincoln Herald Lincolnton Nc

Wake Forest Business Industry Partnership

The Research Triangle Region Is Regularly Cited As One Of The Best Places To Do Business In The Nation Nc Has A Corporate Income Tax Rate Of 3 The Lowest In The Southeast A Variety Of Incentives Are Available At The Local And State Levels For Companies

Nc Needs To Fix Its Tax Code To Secure A Just Recovery For Everyone The Pulse

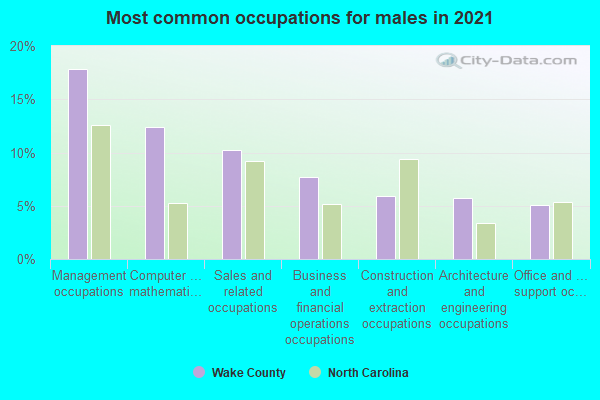

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

February 2022 S Median Sales Price For Wake County Real Estate Shatters Record High At 420 000 Up 10k From January 2022 Wake County Government

2020 Wake County Visitation Figures Released

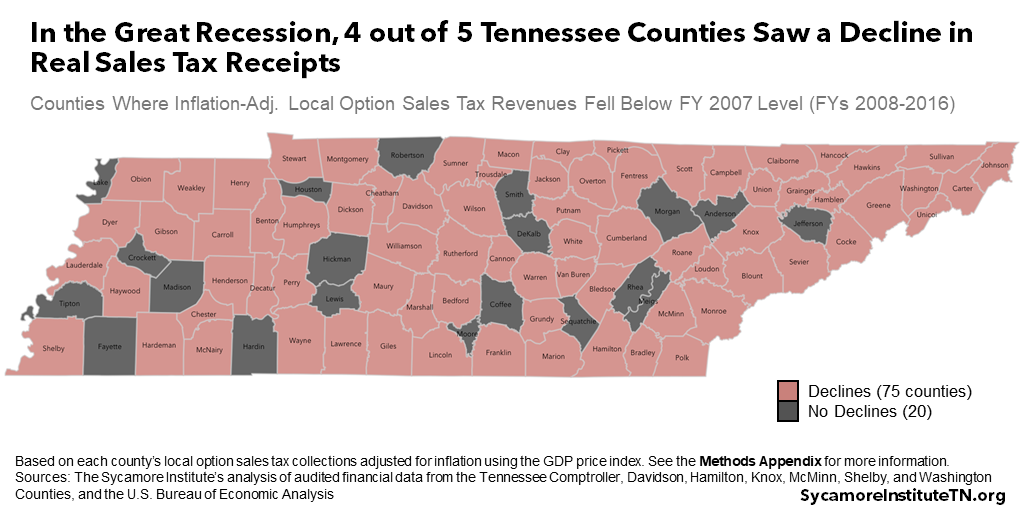

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

The Median Sales Price Of Wake County Real Estate Continued To Climb In June 2021 Wake County Government

North Carolina Sales Tax Rates By County

New Sales Tax Rules For Construction Projects In Nc Gontram Architecture

Sales Taxes In The United States Wikipedia

Wake County Real Estate Prices Up In May Even As Lending Activity Competition Decrease Wral Techwire

Chatham County Property Taxes How Much Am I Gonna Pay Here S How To Figure It Out For Chatham County Pittsboro Siler City

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Sales Tax Calculator Reverse Sales Dremployee